Cleva Vacmaster® AllergenPro™ Respira and Captura Vacuum Cleaners

Before planning and buying an advertising campaign for Cleva, Route evaluated the media investment from advertisers within the vacuum cleaner sector as reported by Nielsen across 2020. The analysis was for national advertising expenditure across the UK and Northern Ireland, excluding online investment including Google, Facebook and selected online display networks

Key Findings

Market: Total advertising expenditure across the sector is over £57m, 1.2% of which is from the electrical retailers such as Currys advertising vacuum products

Seasonality: Expenditure is upweighted across September to October and February. However this trend would be impacted by Covid and the restrictions on retail particularly in November

Media Type: TV is the key media taking a 70% share of ad spend across the sector

Key advertisers: Vax, Gtech, Dyson and Shark are the key advertisers representing 95% of the market

Seasonality: Expenditure is upweighted from August to October, however Covid impacted this trend particularly in November.

Cleva launched the Captura and Respira vacuum cleaners into the UK domestic market in December 2021. Paid media commenced 22/12.

The products are designed to appeal to “allergy- conscious”, “hygiene-focused” consumers, with features such as Allergen Seals and No Plume Bags.

Products are mid-range, UC Model (canister) retails £129.99 – £149.99

Media Objective

Build brand awareness of the Vacmaster range.

Drive online traffic and consumer engagement within a dedicated online destination.

Generate online sales (sold exclusively online).

Audience

Demographically: Predominantly female 35+ C1/C2

Behaviourally: Interest in health, hygiene, wellbeing and allergy. Pet owners. Consumers seeking a deep clean. “Caring Cleaners”. New homeowners.

Media Strategy

Activation within AV channels, a trusted and impactful medium to drive from the top of the consumer marketing funnel down. The recommended strategy for Cleva within a competitive market and working within the assigned campaign budget, which is able to buy a lower share of audience voice, is to deliver a blend of lower volume targeted broadcaster VOD, with higher volume lower cost response TV, to deliver effective results.

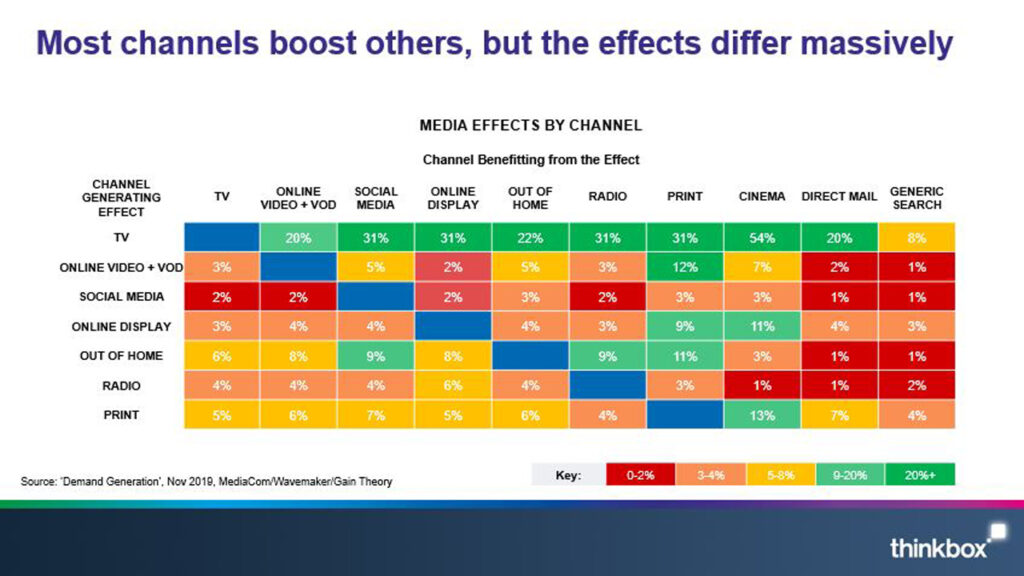

TV activity increase customer acquisition and generates uplift across all channels.

Digital channels to connect with the right audience, contextually and behaviourally with the ability to optimise programmatically. Amplifying the impact of the audio-visual channels.

Active digital channels: Digital Display, Digital Native, Facebook, Google PPC, Google Shopping, Bing.